The landscape of healthcare coverage is constantly evolving, and navigating the options can feel overwhelming. Understanding the details of your health insurance plan is crucial for making informed decisions about your healthcare needs. Factors like deductibles, copays, and covered services all play a significant role in determining your out-of-pocket expenses and access to care.

Many individuals and families are seeking affordable and comprehensive healthcare solutions. As we approach the end of one year and begin preparing for the next, it’s essential to review your current health plan and explore alternatives that may better suit your changing circumstances. Changes in employment, family size, or health status can all impact your healthcare needs and the optimal coverage for you.

This year, countless individuals are scrutinizing different plans to find one that offers a balance between affordability and comprehensive benefits. It’s a balancing act that requires careful consideration of various factors, from monthly premiums to the network of providers included in the plan.

With the rise of new healthcare plans and changing regulations, staying informed is more important than ever. This article delves into the specifics of one such plan, providing a detailed overview of its key features and benefits. It’s a snapshot of the healthcare options available as we head into the future.

Let’s take a close look at one particular plan, 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay, and explore its key components to better understand the coverage it offers. Understanding these details can empower you to make informed choices about your healthcare.

Understanding the Basics of the Plan

Deductible Explained

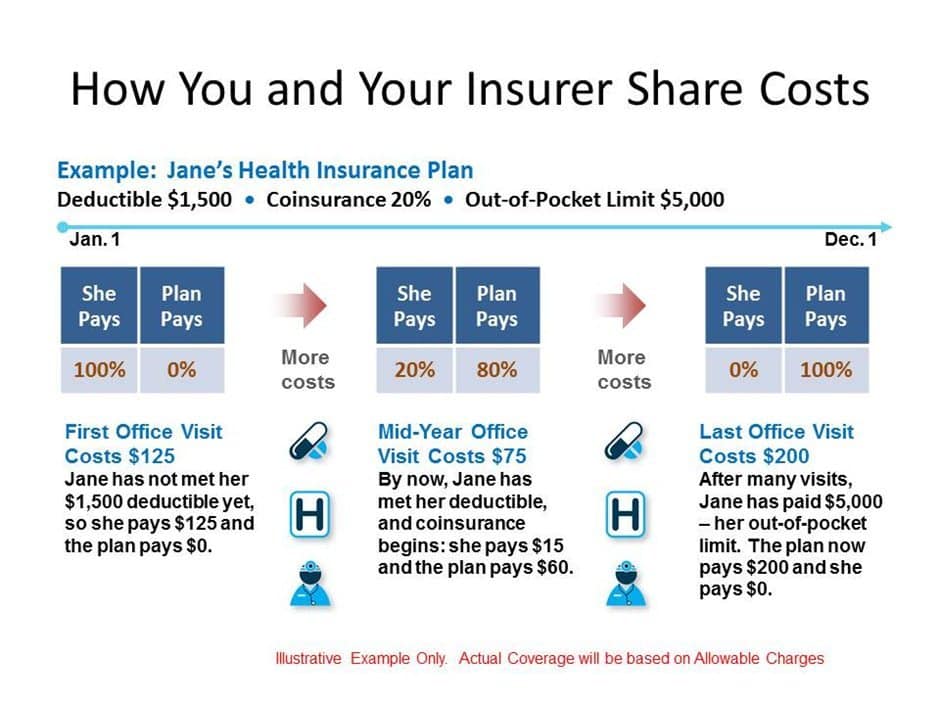

The deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance plan starts to pay. For the 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay, the deductible is $600. This means that you will need to pay $600 in covered medical expenses before HealthPartners begins to cover the remaining costs of your healthcare.

It’s important to note that not all services are subject to the deductible. Some services, like preventive care, may be covered at 100% even before you meet your deductible. Always refer to your plan documents for a comprehensive list of services subject to the deductible.

Choosing a plan with a lower deductible typically means higher monthly premiums, but lower out-of-pocket expenses when you need healthcare. Conversely, a higher deductible often results in lower monthly premiums but requires you to pay more out-of-pocket before your insurance kicks in.

Consider your anticipated healthcare needs when choosing a plan with a specific deductible. If you anticipate needing frequent medical care, a lower deductible may be more advantageous. If you are generally healthy and rarely require medical attention, a higher deductible may be a more cost-effective option.

Understanding your deductible is crucial for budgeting for healthcare expenses and making informed decisions about when to seek medical care. Keeping track of your medical expenses and how close you are to meeting your deductible can help you plan for upcoming healthcare costs.

Copay Explained

A copay is a fixed amount you pay for covered healthcare services at the time of service. For the 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay, the copay is $30. This means that for certain covered services, such as a doctor’s visit, you will pay a $30 copay.

Copays typically apply to routine doctor’s visits, specialist visits, and urgent care visits. The specific copay amount may vary depending on the type of service you receive and the provider you see. Refer to your plan documents for details on copay amounts for different services.

Copays do not typically count towards your deductible. They are separate payments that you make in addition to your deductible. However, once you have met your deductible, your insurance will generally cover a greater portion of your healthcare costs, and you may only be responsible for copays.

Understanding your copay amounts can help you anticipate the cost of routine healthcare services. If you frequently visit the doctor or specialist, the copay amounts can significantly impact your overall healthcare expenses.

Some plans may offer different copay amounts for in-network and out-of-network providers. Choosing in-network providers can often result in lower copays and lower overall healthcare costs. Always verify that your provider is in your plan’s network before seeking care.

Key Features of HealthPartners Coverage

Preventive Care Benefits

HealthPartners, like many insurance providers, emphasizes the importance of preventive care. The 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay is likely to include coverage for a range of preventive services, such as annual check-ups, vaccinations, and screenings.

Preventive care is crucial for maintaining good health and detecting potential health problems early. Early detection can often lead to more effective treatment and better health outcomes.

Many preventive services are covered at 100%, meaning you won’t have to pay a deductible or copay. This encourages individuals to seek preventive care without worrying about out-of-pocket expenses.

Review your plan documents to understand the specific preventive services that are covered and the coverage details. Common preventive services include annual physical exams, flu shots, mammograms, and colonoscopies.

Taking advantage of preventive care benefits can help you stay healthy and potentially avoid more costly medical treatments in the future. Schedule regular check-ups and screenings as recommended by your healthcare provider.

Prescription Drug Coverage

Prescription drug coverage is an essential component of any health insurance plan. The 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay will likely include coverage for a range of prescription medications, but the specific details of the coverage can vary.

Prescription drug coverage typically involves a tiered system, with different copay amounts for different types of medications. Generic medications usually have the lowest copays, while brand-name medications and specialty drugs may have higher copays.

Your plan may also have a formulary, which is a list of covered medications. Medications that are not on the formulary may not be covered, or they may be subject to higher copays or coinsurance.

It’s important to understand your plan’s prescription drug coverage details and formulary to ensure that your medications are covered and to estimate your out-of-pocket expenses for prescription drugs.

Consider using generic medications whenever possible to save money on prescription costs. Talk to your doctor about generic alternatives to brand-name medications.

In-Network vs. Out-of-Network Coverage

Understanding Network Restrictions

HealthPartners, like most insurance plans, operates with a network of healthcare providers. The 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay will likely have a network of doctors, hospitals, and other healthcare providers who have agreed to accept HealthPartners’ payment rates.

Using in-network providers typically results in lower out-of-pocket expenses, as these providers have agreed to accept discounted rates. Out-of-network providers, on the other hand, may charge higher rates, and you may be responsible for paying the difference between the billed amount and the amount that HealthPartners is willing to pay.

Some plans may have limited or no coverage for out-of-network services, except in emergency situations. It’s crucial to understand your plan’s network restrictions to avoid unexpected medical bills.

Always verify that your healthcare provider is in your plan’s network before seeking care. You can typically find a list of in-network providers on the HealthPartners website or by contacting HealthPartners member services.

In emergency situations, you should seek medical care at the nearest hospital or emergency room, regardless of whether it is in your plan’s network. Your plan will typically cover emergency services, but you may be responsible for higher out-of-pocket expenses if the hospital is out-of-network.

Impact on Costs

Choosing in-network providers significantly impacts your healthcare costs. The 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay, like other plans, offers the most cost-effective care when you stay within the network.

In-network providers have agreed to negotiated rates with HealthPartners, which means you’ll pay less for services than you would with an out-of-network provider. These negotiated rates directly translate to lower out-of-pocket costs for you.

Out-of-network providers, on the other hand, can charge any amount they deem appropriate, and you may be responsible for the difference between what they charge and what HealthPartners is willing to pay. This difference can be substantial and lead to unexpected medical bills.

The cost difference between in-network and out-of-network care can be especially significant for expensive procedures or hospital stays. Choosing in-network providers can save you hundreds or even thousands of dollars.

Always prioritize in-network care whenever possible to minimize your out-of-pocket expenses. Utilize HealthPartners’ online provider directory or contact member services to find in-network providers in your area.

Comparing this Plan to Other Options

Premium Considerations

When comparing the 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay to other options, the monthly premium is a crucial factor to consider. The premium is the amount you pay each month to maintain your health insurance coverage.

The premium amount typically depends on several factors, including your age, location, and the level of coverage you choose. Plans with lower deductibles and copays tend to have higher premiums, while plans with higher deductibles and copays tend to have lower premiums.

Consider your budget and healthcare needs when evaluating premium costs. If you anticipate needing frequent medical care, a plan with a higher premium but lower deductible and copays may be more cost-effective in the long run.

Obtain quotes for different plans to compare premium costs and coverage details. Be sure to consider the total cost of healthcare, including premiums, deductibles, copays, and coinsurance, when making your decision.

Explore options for subsidies or financial assistance that may be available to help you pay for your health insurance premiums. Government subsidies and employer-sponsored plans can significantly reduce your out-of-pocket costs.

Coverage Depth Comparison

The depth of coverage offered by the 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay should be compared to other available plans. This involves assessing what services are covered and to what extent.

Some plans may offer more comprehensive coverage, including benefits for services such as vision, dental, or alternative medicine. These plans may have higher premiums but can provide greater peace of mind if you anticipate needing these services.

Other plans may offer more limited coverage, focusing primarily on essential medical services. These plans may have lower premiums but may require you to pay more out-of-pocket for certain services.

Carefully review the plan documents to understand the specific services that are covered and any limitations or exclusions. Consider your individual healthcare needs and choose a plan that provides adequate coverage for the services you are likely to use.

Pay close attention to coverage for chronic conditions or pre-existing health conditions. Ensure that the plan covers the necessary medications, treatments, and specialist visits for managing your health conditions.

Making an Informed Decision

Assess Your Healthcare Needs

Before choosing any health insurance plan, including the 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay, take a moment to assess your individual healthcare needs. Consider your current health status, any chronic conditions you may have, and your anticipated healthcare utilization for the upcoming year.

If you have chronic conditions or require frequent medical care, a plan with a lower deductible and copays may be more suitable for you. This type of plan will help to minimize your out-of-pocket expenses for routine medical visits and prescription drugs.

If you are generally healthy and rarely require medical attention, a plan with a higher deductible and lower premiums may be a more cost-effective option. This type of plan will help to keep your monthly costs down, while still providing coverage for unexpected medical expenses.

Consider your family’s healthcare needs as well. If you have children or other family members who require frequent medical care, choose a plan that provides adequate coverage for their needs.

Talk to your doctor or other healthcare providers to get their recommendations on the type of health insurance plan that is best suited for your individual needs.

Review Plan Documents Carefully

Once you have assessed your healthcare needs, carefully review the plan documents for the 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay and any other plans you are considering. Pay close attention to the following:

Deductible: The amount you must pay out-of-pocket before your insurance coverage begins.

Copays: The fixed amount you pay for certain covered services, such as doctor’s visits and prescription drugs.

Coinsurance: The percentage of healthcare costs you are responsible for paying after you have met your deductible.

Network: The network of doctors, hospitals, and other healthcare providers who have agreed to accept your insurance plan.

Formulary: The list of prescription drugs covered by your plan.

Exclusions: The services or treatments that are not covered by your plan.

By carefully reviewing the plan documents, you can gain a clear understanding of your coverage and potential out-of-pocket expenses. If you have any questions, contact HealthPartners member services for clarification.

Conclusion

Understanding the details of your health insurance plan is vital for navigating the healthcare system effectively. The 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay offers a specific set of benefits and costs that may or may not align with your individual needs.

It is important to compare various plans, consider your healthcare needs, and review plan documents thoroughly to make an informed decision. Taking the time to research and understand your options can save you money and ensure you have access to the healthcare you need.

Remember to consider premiums, deductibles, copays, network restrictions, and coverage depth when evaluating different plans. Don’t hesitate to seek assistance from a health insurance broker or consultant to help you navigate the complex landscape of healthcare coverage.

For more information on other health insurance plans and related topics, be sure to check out our other articles!

We hope this information has been helpful in your quest for comprehensive and affordable healthcare. Stay informed and make the best decision for your health and well-being.

- 12/31/2025 HealthPartners:$600 deductible Plan-$30 Copay