HealthPartners, a renowned healthcare provider, is a cornerstone of community health in the regions it serves. For many considering a career in the healthcare sector, understanding compensation is just as important as the desire to make a difference. The organization has a longstanding reputation for its commitment to patient care and employee well-being, making it an attractive employer for healthcare professionals at all stages of their careers. Understanding the intricacies of salary structures within such a prominent organization requires delving into various factors, from job roles and experience levels to regional variations and the overall economic climate. Therefore, potential employees and those considering career moves often search for detailed information about salary expectations.

The allure of a stable and rewarding career in healthcare is undeniable, and HealthPartners stands out as a potential haven for those seeking both professional fulfillment and financial security. Choosing the right career path involves careful consideration of numerous factors, including work-life balance, opportunities for advancement, and, of course, compensation. As a large and multifaceted organization, HealthPartners offers a wide range of positions, each with its own unique set of responsibilities and corresponding salary ranges. Researching typical compensation benchmarks is a critical step in assessing whether a career at HealthPartners aligns with one’s financial goals and expectations.

Moreover, the healthcare industry is constantly evolving, with new technologies, regulations, and patient care models emerging regularly. This dynamism impacts the roles and responsibilities of healthcare professionals, and subsequently, their compensation. Keeping abreast of industry trends and understanding how they affect salary expectations is crucial for anyone considering a career in the healthcare sector, particularly at an organization like HealthPartners that is committed to innovation and excellence.

The competitive landscape of the healthcare job market necessitates that individuals are well-informed about compensation standards. This knowledge empowers them to negotiate effectively and make informed career decisions. Understanding the factors that influence salary levels, such as education, experience, and specialization, enables individuals to assess their market value and identify opportunities for professional growth and increased earning potential.

Therefore, navigating the world of healthcare compensation requires a comprehensive approach. By exploring the various facets of salary structures and considering the factors that contribute to earning potential, individuals can make well-informed decisions about their career paths and maximize their opportunities for professional and financial success. Knowing what to expect is an essential part of planning your future. To that end, understanding the **Average Salary for Healthpartners** is key to making informed decisions.

Understanding Salary Benchmarks at HealthPartners

Delving into salary benchmarks is essential for understanding the financial landscape within HealthPartners. Benchmarks provide a general understanding of expected compensation for various positions. These benchmarks are often influenced by factors such as industry standards, geographic location, and the size and revenue of the organization.

A salary benchmark serves as a reference point, allowing prospective employees to gauge whether a particular job offer aligns with their experience and skill set. It also provides a baseline for negotiating salaries and benefits packages. Understanding these benchmarks is not just about the numbers; it’s about understanding your worth within the healthcare ecosystem.

When exploring benchmarks, it’s important to consider the role of cost of living. For example, a salary that seems high in one geographic area might not stretch as far in another with a higher cost of living. Factors such as housing costs, transportation expenses, and taxes can significantly impact the real value of a salary.

Moreover, benchmarks can reveal trends and patterns within the organization. For instance, they might indicate whether certain departments or roles are more highly valued or whether there’s a commitment to competitive compensation across all levels. These insights can be invaluable for career planning and professional development.

In the context of HealthPartners, salary benchmarks can help potential employees understand the organization’s compensation philosophy and its commitment to attracting and retaining top talent. By comparing HealthPartners’ benchmarks to industry averages, individuals can gain a clearer picture of the organization’s competitive position in the healthcare job market.

Factors Influencing Salary

Several factors influence the average salary at HealthPartners and other healthcare organizations. Education level, years of experience, specialized skills, and job title are among the most significant determinants of compensation.

A higher level of education, such as a master’s or doctoral degree, often translates to higher earning potential, especially in specialized fields like medicine, nursing, and research. Years of experience also play a crucial role, as seasoned professionals typically command higher salaries due to their accumulated knowledge and expertise.

Specialized skills, such as proficiency in specific medical procedures or software systems, can also increase earning potential. In-demand skills are often highly valued by employers, who are willing to pay a premium for candidates who possess them.

Job title and level of responsibility are also key factors. Higher-level positions with greater managerial or clinical responsibilities typically come with higher salaries. This reflects the increased demands and complexities associated with these roles.

In addition to these individual factors, external factors such as market demand and economic conditions can also influence salary levels. High demand for certain healthcare professions can drive up salaries, while economic downturns can lead to salary freezes or reductions.

The Role of Negotiation

Negotiation plays a vital role in determining the final salary package for any employee. It’s crucial to be prepared with research, understand your worth, and know how to articulate your value to the employer.

Before entering into salary negotiations, it’s essential to research industry standards and understand the average salary for similar positions in your geographic area. This information provides a solid foundation for your negotiation strategy.

During negotiations, it’s important to highlight your skills, experience, and accomplishments. Quantify your contributions whenever possible, demonstrating the value you bring to the organization. Be confident in your abilities and don’t be afraid to ask for what you deserve.

Remember that salary is not the only factor to consider. Benefits packages, including health insurance, retirement plans, and paid time off, can also significantly impact your overall compensation. Be sure to evaluate the entire package before making a decision.

Negotiation is a two-way street. Be open to compromise and willing to find common ground with the employer. A win-win outcome is always the best approach, ensuring that both you and the organization are satisfied with the final agreement.

Specific Job Roles and Their Average Salaries at HealthPartners

HealthPartners, like any major healthcare provider, offers a wide range of roles, each with its own unique responsibilities and corresponding salary expectations. Understanding these differences is crucial when researching **Average Salary for Healthpartners**.

The salaries for different positions vary widely depending on the level of education, experience, and specialization required. Clinical roles, such as physicians and nurses, often command higher salaries due to the extensive training and expertise involved.

Administrative and support roles, while equally important to the organization’s functioning, typically have different salary ranges. These roles often require different skill sets and levels of education, which are reflected in their compensation.

Furthermore, the demand for specific skills and specialties can also influence salary levels. For example, in areas with a shortage of certain medical specialists, salaries for those positions may be higher than average.

Therefore, it’s essential to research the specific requirements and responsibilities of each job role when considering a career at HealthPartners. This research will provide a more accurate understanding of the potential salary expectations for that particular position.

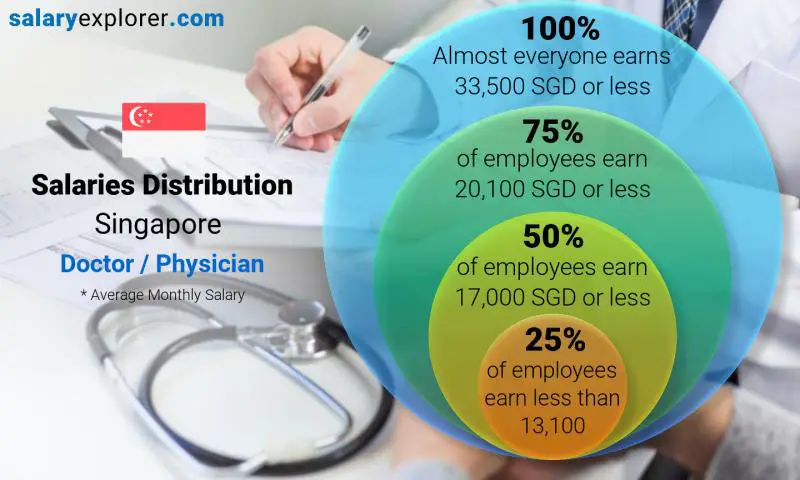

Physician Salaries

Physician salaries at HealthPartners, as in most healthcare organizations, are among the highest, reflecting the extensive education, training, and responsibility associated with the profession. Different specialties within medicine also command varying levels of compensation.

Surgeons, for instance, typically earn more than primary care physicians due to the complexity and high-risk nature of their work. Similarly, specialists in high-demand areas, such as cardiology or oncology, may also command higher salaries.

Experience also plays a significant role in determining physician salaries. Seasoned physicians with years of experience often earn more than those who are just starting their careers.

Furthermore, the type of employment arrangement can also impact physician salaries. Physicians who are employed directly by HealthPartners may have different compensation structures than those who are affiliated with the organization through partnerships or contracts.

It’s important for prospective physicians to research the specific salary ranges for their specialty and experience level at HealthPartners to gain a realistic understanding of their potential earning potential.

Nursing Salaries

Nursing salaries at HealthPartners vary depending on the level of education, experience, and specialization. Registered nurses (RNs) with advanced degrees or specialized certifications typically earn more than those with basic credentials.

Specialty nursing roles, such as critical care nurses or operating room nurses, often command higher salaries due to the specialized skills and knowledge required. These roles often involve working in high-stress environments and dealing with critically ill patients.

Experience also plays a significant role in determining nursing salaries. Experienced nurses with years of clinical experience often earn more than those who are new to the profession.

Furthermore, the geographic location can also impact nursing salaries. Areas with a high demand for nurses may offer higher salaries to attract and retain talent.

Prospective nurses should research the specific salary ranges for their level of education, experience, and specialization at HealthPartners to gain a realistic understanding of their potential earning potential.

Administrative and Support Staff Salaries

Administrative and support staff salaries at HealthPartners vary depending on the job title, level of education, and years of experience. These roles are essential to the smooth functioning of the organization and encompass a wide range of responsibilities.

Positions such as medical secretaries, administrative assistants, and billing specialists typically have different salary ranges. The responsibilities and required skill sets for these roles can vary significantly, which is reflected in their compensation.

Experience also plays a role in determining salaries for administrative and support staff. Experienced professionals with a proven track record of performance often earn more than those who are new to the field.

Furthermore, the size and complexity of the department or team can also impact salaries. Individuals who manage larger teams or have more complex responsibilities may command higher salaries.

Prospective administrative and support staff should research the specific salary ranges for their job title and experience level at HealthPartners to gain a realistic understanding of their potential earning potential.

Regional Variations in HealthPartners Salary Structures

It’s important to consider regional variations when researching **Average Salary for Healthpartners**. Healthcare costs, competition, and labor market dynamics affect compensation across various locations.

HealthPartners operates in multiple locations, and salary structures can differ depending on the cost of living and the competitive landscape in each region. Salaries in urban areas with a higher cost of living may be higher than those in rural areas.

Furthermore, the demand for certain healthcare professionals can also vary by region. Areas with a shortage of nurses or physicians may offer higher salaries to attract and retain talent.

The presence of other major healthcare providers in the region can also influence salary levels. HealthPartners may need to offer competitive salaries to attract and retain employees in areas with a high concentration of healthcare organizations.

Therefore, it’s important to consider the specific location of the job when researching salary expectations at HealthPartners. Understanding the regional variations in salary structures can help you make informed decisions about your career.

Cost of Living Adjustments

Cost of living adjustments (COLAs) are often incorporated into salary structures to account for differences in the cost of living across different regions. These adjustments ensure that employees maintain a comparable standard of living regardless of their location.

HealthPartners, like many organizations, may offer COLAs to employees who work in areas with a higher cost of living. These adjustments help to offset the higher expenses associated with living in these regions, such as housing, transportation, and groceries.

The specific amount of the COLA can vary depending on the region and the organization’s compensation philosophy. Some organizations may use a standardized COLA percentage, while others may calculate COLAs based on specific cost of living indices.

It’s important to understand how COLAs are calculated and applied when evaluating salary offers. A seemingly high salary in one region may be less attractive after accounting for the cost of living in that area.

When researching salary expectations at HealthPartners, be sure to factor in the cost of living in the specific location of the job and inquire about any COLAs that may be available.

Competitive Market Analysis

Competitive market analysis involves researching the salary structures of other healthcare organizations in the same region. This analysis helps HealthPartners to understand how its compensation practices compare to those of its competitors.

HealthPartners may conduct competitive market analyses to ensure that its salaries are competitive and that it can attract and retain top talent. This analysis may involve surveying other healthcare organizations, reviewing industry salary reports, and gathering feedback from employees.

The results of the competitive market analysis can inform HealthPartners’ decisions about salary adjustments and benefit enhancements. If the analysis reveals that HealthPartners’ salaries are below market average, the organization may need to increase salaries to remain competitive.

Understanding the competitive market analysis can provide valuable insights into the salary landscape in a particular region. This information can help you to negotiate effectively and make informed decisions about your career.

When researching salary expectations at HealthPartners, consider exploring the competitive landscape in the specific region and researching the salary structures of other healthcare organizations.

Local Economic Conditions

Local economic conditions, such as unemployment rates and economic growth, can also influence salary levels. A strong local economy may lead to higher salaries, while a weak economy may result in salary freezes or reductions.

HealthPartners, like all organizations, is affected by the economic conditions in the regions where it operates. A strong local economy can boost demand for healthcare services and increase revenue, which may allow HealthPartners to offer higher salaries.

Conversely, a weak local economy can reduce demand for healthcare services and decrease revenue, which may lead to cost-cutting measures, including salary freezes or reductions.

Monitoring local economic conditions can provide valuable insights into the salary outlook at HealthPartners. Staying informed about economic trends can help you to anticipate potential changes in salary levels and make informed career decisions.

When researching salary expectations at HealthPartners, consider exploring the local economic conditions in the specific region and researching the economic outlook for the healthcare industry.

Benefits and Perks Beyond Salary at HealthPartners

While understanding the **Average Salary for Healthpartners** is important, compensation extends beyond just the base pay. Benefits and perks play a crucial role in the overall financial well-being of an employee. These can include health insurance, retirement plans, paid time off, and other non-monetary benefits.

Health insurance is a significant benefit for many employees, as it provides access to affordable healthcare services. The quality and coverage of health insurance plans can vary widely between employers, so it’s important to understand the specifics of the plan offered by HealthPartners.

Retirement plans, such as 401(k)s, are also valuable benefits, as they help employees save for their future. Employer contributions to retirement plans can significantly boost an employee’s savings over time.

Paid time off (PTO), including vacation days, sick days, and holidays, allows employees to take time off work for rest and relaxation. Adequate PTO is essential for maintaining work-life balance and preventing burnout.

In addition to these standard benefits, HealthPartners may also offer other perks, such as tuition reimbursement, employee discounts, and wellness programs. These perks can enhance the overall employee experience and contribute to job satisfaction.

Health Insurance Plans

HealthPartners typically offers a variety of health insurance plans to its employees, allowing them to choose the plan that best meets their needs and preferences. These plans may include options such as health maintenance organizations (HMOs), preferred provider organizations (PPOs), and high-deductible health plans (HDHPs).

HMOs typically require employees to choose a primary care physician (PCP) who coordinates their care. PPOs allow employees to see any doctor or specialist without a referral, but may have higher out-of-pocket costs.

HDHPs have lower monthly premiums but higher deductibles. These plans may be a good option for employees who are generally healthy and don’t anticipate needing a lot of medical care.

It’s important to carefully review the details of each health insurance plan, including the premiums, deductibles, copays, and coverage levels, to determine which plan is the best fit for your needs.

HealthPartners may also offer dental and vision insurance plans to its employees. These plans can help to cover the costs of dental and vision care, which are not typically covered by standard health insurance plans.

Retirement Savings Options

HealthPartners typically offers a 401(k) plan to its employees, allowing them to save for retirement on a tax-deferred basis. The organization may also offer matching contributions to the 401(k) plan, which can significantly boost an employee’s savings over time.

A 401(k) plan allows employees to contribute a portion of their salary to a retirement account, which is then invested in a variety of stocks, bonds, and mutual funds. The earnings on these investments grow tax-deferred, meaning that employees don’t have to pay taxes on the earnings until they withdraw them in retirement.

Employer matching contributions are a valuable benefit, as they essentially provide free money to employees. For example, HealthPartners may match 50% of an employee’s contributions up to a certain percentage of their salary.

It’s important to take advantage of the 401(k) plan and contribute enough to receive the full employer match. This can significantly increase your retirement savings over time.

HealthPartners may also offer other retirement savings options, such as a pension plan or an employee stock purchase plan. These plans can provide additional sources of retirement income.

Paid Time Off Policies

HealthPartners typically offers a generous paid time off (PTO) policy to its employees, including vacation days, sick days, and holidays. Adequate PTO is essential for maintaining work-life balance and preventing burnout.

The amount of PTO offered may vary depending on the employee’s job title, years of service, and performance. Employees with more experience or higher-level positions may be entitled to more PTO.

PTO can be used for a variety of purposes, such as vacation, illness, personal appointments, or family emergencies. It’s important to understand the specific rules and guidelines for using PTO.

Some organizations may offer unlimited PTO, which allows employees to take as much time off as they need, as long as they are meeting their job responsibilities. However, unlimited PTO policies may come with certain restrictions.

HealthPartners may also offer paid holidays throughout the year, such as Christmas, Thanksgiving, and Independence Day. These holidays provide employees with additional time off to spend with their families and friends.

Factors to Consider Before Accepting a Job Offer

Before accepting a job offer from HealthPartners, or any employer, it’s essential to carefully evaluate the entire compensation package, including salary, benefits, and perks. Consider the long-term implications of your decision.

Ensure the salary aligns with your skills, experience, and industry standards. Compare the offer to similar roles in the region and consider your financial needs and goals. Don’t hesitate to negotiate if you feel the initial offer is not adequate.

Evaluate the benefits package, including health insurance, retirement plans, and PTO. Understand the details of each benefit and how it contributes to your overall financial well-being. Factor in the value of these benefits when comparing job offers.

Assess the work environment and culture. Consider factors such as work-life balance, opportunities for professional development, and the organization’s values and mission. A positive work environment can significantly impact your job satisfaction and overall well-being.

Think about the long-term career prospects at HealthPartners. Consider the opportunities for advancement, training, and growth within the organization. Choose a job that aligns with your career goals and provides opportunities for professional development.

Assessing Your Financial Needs

Assessing your financial needs is a crucial step in evaluating a job offer. Consider your monthly expenses, debt obligations, and savings goals to determine whether the salary offered is sufficient to meet your needs.

Create a budget that outlines your income and expenses. Identify areas where you can cut back on spending and prioritize your financial goals. Use budgeting tools and apps to track your progress and stay on track.

Factor in the cost of living in the specific location of the job. Housing costs, transportation expenses, and taxes can vary significantly between regions. Ensure that the salary offered is sufficient to cover these expenses.

Consider your debt obligations, such as student loans, car loans, and credit card debt. Determine how much of your salary will be allocated to debt repayment and whether the salary offered is sufficient to meet these obligations.

Think about your savings goals, such as saving for retirement, a down payment on a house, or your children’s education. Ensure that the salary offered allows you to save enough to meet these goals.

Evaluating Work-Life Balance

Evaluating work-life balance is essential for maintaining your well-being and preventing burnout. Consider the organization’s policies on working hours, flexible work arrangements, and PTO.

Determine whether the job requires long hours or frequent travel. Assess whether you are willing and able to commit to these demands without sacrificing your personal life.

Inquire about the organization’s policies on flexible work arrangements, such as telecommuting or flexible hours. These arrangements can help you to better manage your work and personal responsibilities.

Evaluate the organization’s culture and its commitment to work-life balance. Look for signs that the organization values its employees’ well-being and supports their efforts to maintain a healthy balance between work and personal life.

Consider your personal values and priorities. Determine what is most important to you in terms of work-life balance and choose a job that aligns with these values.

Negotiating for a Better Package

Negotiating for a better package is a common and often expected part of the job offer process. Don’t be afraid to ask for what you deserve, but be prepared to justify your requests with solid evidence.

Research industry standards and understand the average salary for similar positions in your geographic area. Use this information to support your request for a higher salary.

Highlight your skills, experience, and accomplishments. Quantify your contributions whenever possible, demonstrating the value you bring to the organization.

Be open to negotiating non-salary benefits, such as health insurance, retirement plans, and PTO. These benefits can be just as valuable as a higher salary.

Be prepared to walk away if the employer is unwilling to meet your needs. Know your bottom line and don’t settle for a package that doesn’t meet your financial goals and priorities. Remember understanding the **Average Salary for Healthpartners** is a strong negotiating position.

Conclusion

Understanding the **Average Salary for Healthpartners** requires a comprehensive approach. Considering factors like job role, experience, location, and benefits packages is crucial. This information empowers individuals to make informed career decisions and negotiate effectively. Beyond salary, remember to assess the work environment, culture, and opportunities for professional development.

We hope this guide has provided valuable insights into navigating the complexities of compensation at HealthPartners. Remember, thorough research and preparation are key to securing a rewarding and financially stable career.

If you found this article helpful, be sure to check out our other articles on career advice, salary negotiation, and employee benefits. We are committed to providing you with the information you need to make informed decisions about your career.

Your career journey is a unique and personal one, and we are here to support you every step of the way. Explore our resources and connect with our community to gain valuable insights and advice from experienced professionals.

Thank you for reading, and we wish you the best of luck in your career endeavors!

- The Average Salary for Healthpartners depends on the specific role and experience level.